Come across a review that you would like taken off your business page?

We will review all the guidelines for common review sites and the procedure to get them removed.

Table of Contents

What content would count as a surefire removal (more on Google Review Policy)

- Fake reviews posted to boost or lower ratings

- Reviews that contain or links to content with profanity

- Reviews that contain hateful, abusive or threats to others

- Reviews that outwardly advertise competitors or this business

Steps to Remove the Review

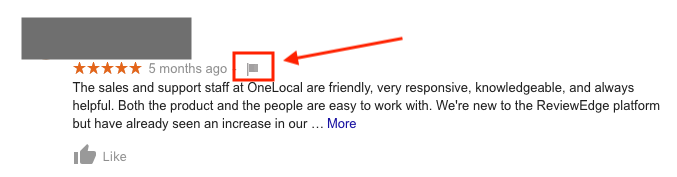

- On the offending review, click the flag icon – pops up when you hover over the respective review

- This opens up a Google Page where you can report a policy violation. Enter your email address and select the violation type.

- Submit the form. Now you are done. Note: you will only hear back from Google if they require additional information from you or they have information to share with you.

Tip: If you can, get multiple people to flag the review, this can increase awareness which may lead to quicker action.

If in a week or two you still have not heard back from Google and the offending review is still up, follow these steps:

- Get in touch with a support associate

- Log in to your Google My Business page

- Click “Reviews”, click on the home menu, click “Support”

- Choose your preferred method of contact (phone or email)

- Fill in the necessary information, add a screenshot of the offending review

- They should reply within 24-48 hours

What content would count as a surefire removal (more on Facebook Community Standards)

- Recommendations that contain content that

- pose a genuine risk of physical harm or contain direct threats to public safety

- contain content that express support to people who engage in dangerous activities

- contain hate speech

- Recommendations written by fake personas

- Recommendations irrelevant to the product or service offered by the business

Steps to Remove the Review

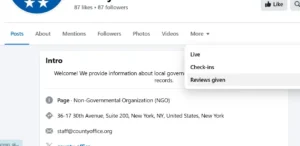

- Navigate to your business’s Facebook page

- Find the Reviews menu under the cover

- Go to the offending Recommendation, click the three dots in the top right corner

- Click “Report post”

- Follow the on-screen instructions.

Facebook response time varies based on the offending content, most reports get replied to in 1-2 days but can also take up to 2 weeks.

Yelp

What content would count as a surefire removal (more on Yelp Policy)

- Reviewer has conflict of interest (is competitor, former employee, affiliated with business, paid review, promoting business or competitor)

- Review not focused on consumers own experience

- Review contains inappropriate material (hate speech, threatening language)

- Review contains false information

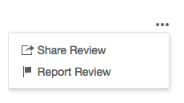

Steps to Remove the Review

- Make sure that you claimed your business on yelp (claim your business here)

- Find the offending review in the “Reviews” section of your business account

- Click on the three dots and click “Report Review”

- Once you submit your report, it takes a few days for Yelp to review it. You will be notified of their decision via email

Yellowpages

What content would count as a surefire removal (more on YellowPages Guidelines)

- Reviews are

- offensive or contain derogatory material

- written to directly damage reputation (mentions name, contact detail, location)

- Reviews contain

- swear words

- claims of food poisoning, medical malpractice or illegal activity

- repeated information (from another review)

- Reviews written by

- competitors

- former employees or fake personas

Steps to Remove the Review

- Find the offending review, click “Report” located below the review

- The review will now show up with “Reported” under it